Being a professional in real estate comes with a lot of knowledge of the housing market, economy, and homeowner guidance. But something to know is that markets move in cycles; real estate is no exception. According to many real estate researchers in the industry, there’s the belief that the real estate market will continue to grow, perhaps at a slower pace.

While the market took some hefty damage during the pandemic, it shifted society in different directions from the norm. Citizens are leaving the cities in droves and transitioning into at-home work in suburban neighborhoods. So, what’s the next step? Here are the tops real estate trends in 2021 investors need to know.

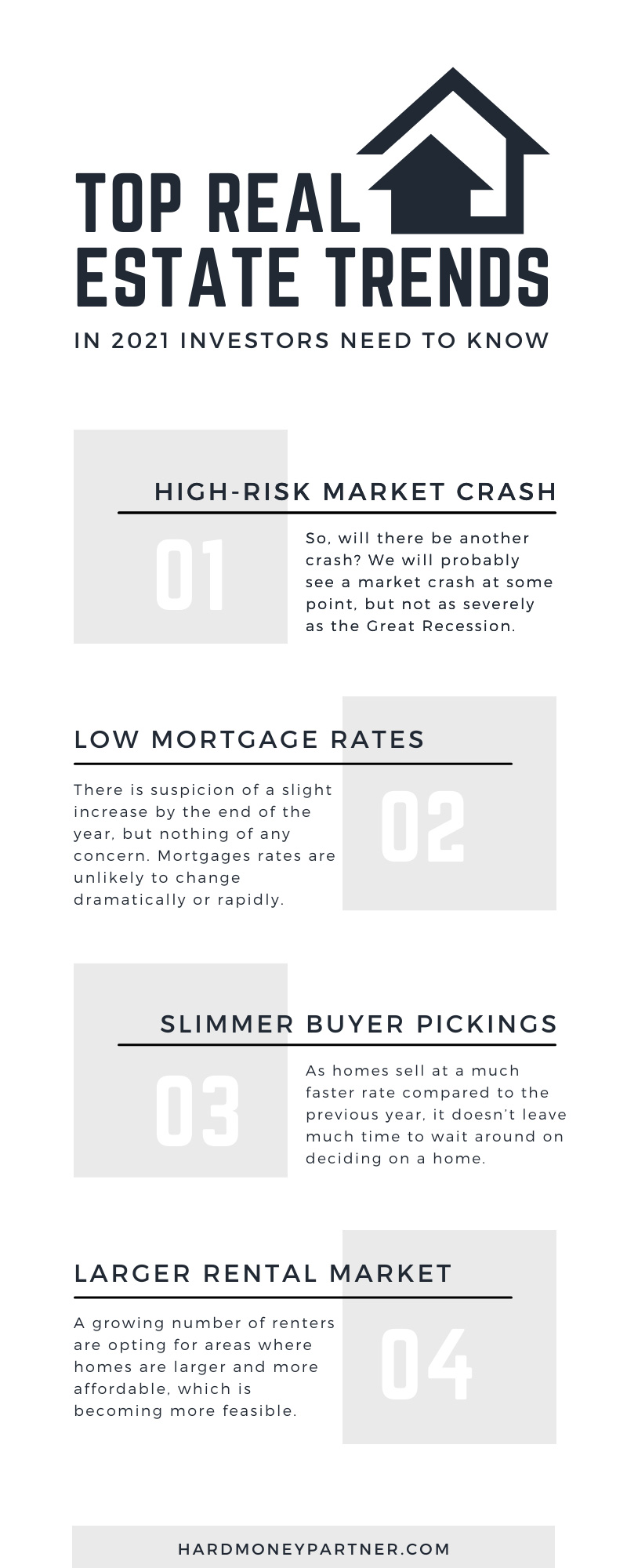

High-Risk Market Crash

Everyone in the real estate business is asking the same question: what will happen to the housing market as 2021 begins to transition into 2022? There’s the preface that the housing market has done incredibly well, especially for investors; interest rates are low, and home prices are decreasing.

So, will there be another crash? There is a risk, as a society can’t maintain the booming housing market forever. We will probably see a market crash at some point, but not as severely as the Great Recession. Regularly keep an eye out for any changes.

Online Real Estate Service Growth

One of the biggest top real estate trends in 2021 investors need to know about is incorporating online housing listings. With the pandemic sweeping the world in the last year, person-to-person interaction decreased dramatically—and with that, the internet came into real estate. Finding and purchasing a home is now faster than ever, and third-party buyers can use online services to buy your house from you.

Using online housing services also can provide you with the option of a virtual agent, alongside the use of closing through online means. Digital technology has made it significantly easier to handle contracts and document-based tasks in the virtual sense. By using electronic signature apps, it can streamline immediately into the buying process.

Low Mortgage Rates

When it comes to mortgages, their rates have remained low. It is one of the reasons the housing market has held out so firmly. There is suspicion of a slight increase by the end of the year, but nothing of any concern. Mortgages rates are unlikely to change dramatically or rapidly.

So, it’s no wonder current homeowners are refinancing their homes and getting a trustworthy lender. With refinancing, homeowners are reevaluating their mortgages or loans and replacing an existing credit agreement. Therefore, if your current mortgage is in a higher percentage, taking advantage right now is an excellent opportunity for lower rates.

Raising Home Prices

Even though mortgage rates are at an all-time low, home prices have increased. With the buyer demand increasing, so do home values. On the other side, supply is low, thus increasing buyers’ costs. It is especially effective on real estate investors and people who wish to seek larger suburban homes due to working from home.

Despite the higher costs of homes, they are selling at unbelievable speeds. Active listings have decreased by more than half year-by-year, meaning there are fewer homes to choose from than one year ago. With a restricted supply, the prices will continue to rise.

Housing Supply Deficit Increase

Over the last year, building permits, housing starts, and completions have increased gradually over the previous few years. Even though the numbers of home buildings grow, so does the housing deficit. It is due to the strong demand for suburban homes and homeowners taking advantage of having a lower mortgage.

There are also speculations of housing demand not decreasing soon due to various reasons. As millennials enter the housing market and the combination of high demand and low supply, it’s no surprise that fewer homes come with fewer pickings. With that said, it will increase buyer’s frustrations and more cases of bidding wars.

Slimmer Buyer Pickings

As previously mentioned, the housing supply is incredibly low due to workers remaining stuck at home. Being on your toes is important to obtain the home buyer’s desire with the low housing market. As homes sell at a much faster rate compared to the previous year, it doesn’t leave much time to wait around on deciding on a home.

As buyers plan on putting an offer on a home that they deem suitable, other families are taking the step of outbidding them. Families are shifting their gazes towards the quality of neighborhoods, convenience for their jobs, and overall home affordability. So, it’s no surprise that buyers are fighting tooth and nail to get the home they want.

Moving Away From Urban Areas

With the rise in working remotely, current urban citizens are eager to move out of their apartments into full-sized homes. It’s especially notable for families wanting to stretch their legs into owning a home that fits their needs. Moving away from urban areas and transitioning into suburban ones makes homes more favorable for remote work and virtual learning.

Real estate investors should note that people are shifting towards rural areas within larger metro areas. Even though people desire to leave the urban cities, many still want to live close enough to take advantage of the city’s amenities.

Larger Rental Market

Even those who don’t wish to own homes can make more choices when it comes to renting. A growing number of renters are opting for areas where homes are larger and more affordable, which is becoming more feasible. While it is expensive to reside in an urban area, small and mid-sized cities receive a significant turnaround in rental demand. Vacant homes are now becoming the renter’s perfect choices, leaving the market within days of their listing and renting into the double-digits.

As home prices keep increasing, many homebuyers take considerably longer to save money and put down payments. So, opting for a rental is more in their reach. Also to note is that becoming a landlord is more accessible than ever, thanks to the incorporation of technology.

If you are looking for hard money lenders in Tulsa, OK, consider us at Hard Money Partner. We offer fast and flexible real estate financing for you and your home. If you have any questions, contact us today to get started on your next real estate venture.