Since there are various types of loans you can use to finance a property, it can be tricky to know which loan is the right one for you and what it entails. Use this article for more information on everything you need to know about hard money loans. If you own a fix and flip business, you should strongly consider this type of loan.

Use this guide to answer your questions, and take your time deciding on the right loan because there are risks that come with each type. In this guide, however, we tackle questions regarding what hard money loans are, what they entail, interest rates, risks, processes, pros and cons, and how to find a lender. Learn why hard money loans are a great financing resource for your next property purchase.

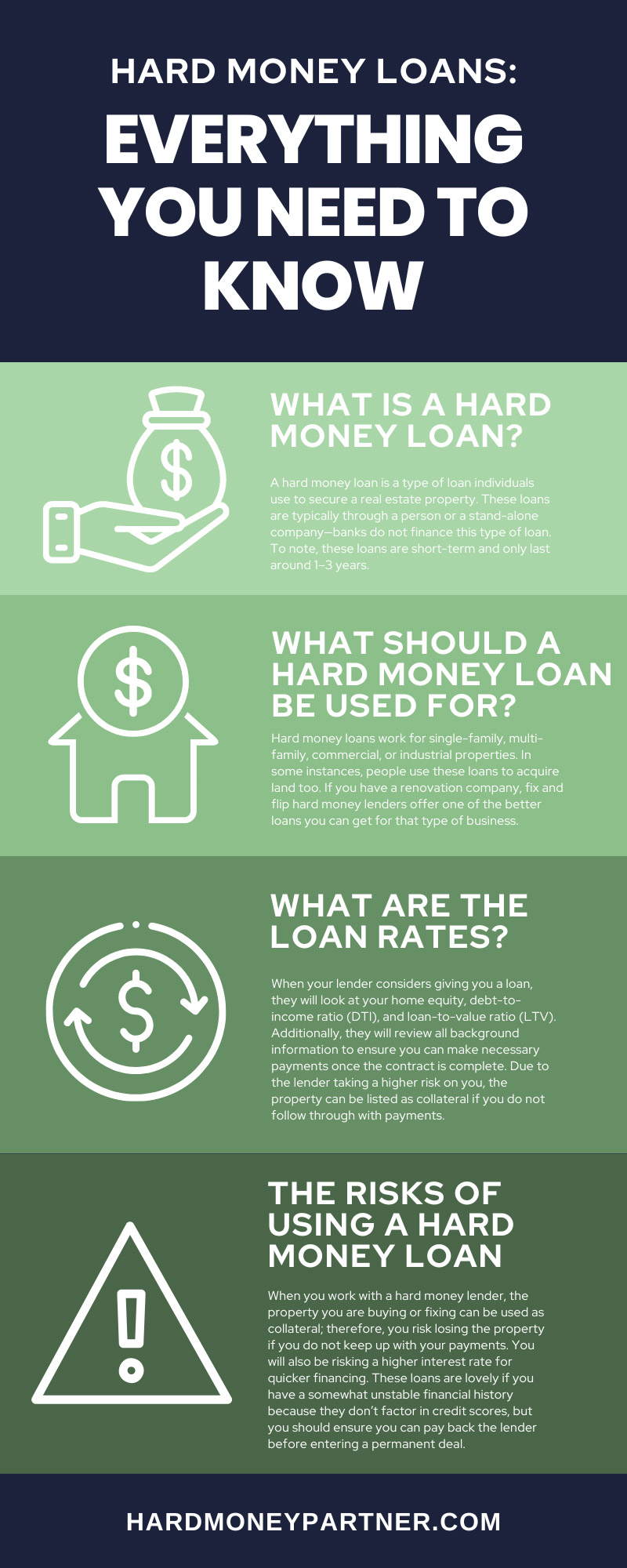

What Is a Hard Money Loan?

A hard money loan is a type of loan individuals use to secure a real estate property. These loans are typically through a person or a stand-alone company—banks do not finance this type of loan. To note, these loans are short-term and only last around 1–3 years.

There is normally a quick turnaround time for these loans, and you can acquire them relatively quickly after approval. The borrower’s financial background is not a driving factor for the loan requirements; instead, they’re based on the property’s value. Because the lender is taking a higher risk on you without looking at credit scores, you will see higher interest rates and origination fees.

What Should a Hard Money Loan Be Used For?

Hard money loans work for single-family, multi-family, commercial, or industrial properties. In some instances, people use these loans to acquire land too. If you have a renovation company, fix and flip hard money lenders offer one of the better loans you can get for that type of business.

Due to the different kinds of properties hard money loans can be used for, ask the lender upfront what type of property they lend for. Never save this question until the very end because your decision on a loan will depend on the answer they give you. Always find a lender that works with the type of property you want to buy.

What Are the Loan Rates?

When your lender considers giving you a loan, they will look at your home equity, debt-to-income ratio (DTI), and loan-to-value ratio (LTV). Additionally, they will review all background information to ensure you can make necessary payments once the contract is complete. Due to the lender taking a higher risk on you, the property can be listed as collateral if you do not follow through with payments.

Interest rates for this loan are around 2–10% higher than one of a traditional loan. The money you get from the lender will be 65–75% of the home’s current value or the house’s value after you repair the property.

The Risks of Using a Hard Money Loan

When you work with a hard money lender, the property you are buying or fixing can be used as collateral; therefore, you risk losing the property if you do not keep up with your payments. You will also be risking a higher interest rate for quicker financing. These loans are lovely if you have a somewhat unstable financial history because they don’t factor in credit scores, but you should ensure you can pay back the lender before entering a permanent deal.

What Does the Loan Process Look Like?

There are several steps to take before receiving the loan. To make the process easier to understand, we broke down the steps for you.

- Find a lender: Investigate the lender to ensure they are reputable.

- Arrange a meeting: Inquire, at this time, about what type of property they finance.

- Prepare a contract: Ensure the lender provides a good deal with a solid financial plan.

- Create a contract price: To increase your chances of approval, ensure you have enough money to buy the property after the lender gives you their sum.

- Appraise the property: The lender may have their own appraisers or a list of trusted ones.

- Prepare additional documents needed: Depending on the lender, they may require additional paperwork, like W2s or bank statements, to complete the deal.

- Wait for the lender’s approval: The lender will inform you of the amount you will be given along with the terms for payment.

- Consult with a lawyer: A lawyer ensures you do not miss any stipulations when the lender sends you a counteroffer.

- Close the loan: You might have to pay closing costs and property insurance.

Pros and Cons of Using a Hard Money Loan

Just like any other loan, hard money loans have pros and cons to them too. While the pros outweigh the cons, you should still put a good amount of thought into the loan decision and whether it is suitable for the property you are buying.

Hard Money Pros

- Speed: You’ll have a quick turnaround time for receiving the loan.

- Flexible: You can negotiate with the lender because banks aren’t involved.

- No red tape: There are minimal hoops to jump through to acquire this type of loan.

- Convenience: Hard money lenders minimize the headaches that come with working with banks and traditional loans.

Hard Money Cons

- Cost: A higher risk equals higher interest rates

- Shorter Repayments: You should fix and flip the property ASAP because hard money loans only last a few months or a few years, depending on the situation.

How To Find a Lender

There are three ways you can find a hard money lender, and the first is through local real estate events being held near you. Second, you can ask a real estate agent or mortgage broker for a hard money lender in your network. Lastly, you can search your city online followed by the term “hard money lender”—although be wary of this because there can be scammers out there with fake websites, so always make sure they are a legitimate resource for loans.

Now that you have everything you need to know about hard money loans, you can better decide which type of loan is best for your property. While hard money loans have higher interest rates and faster payment schedules, they still provide an excellent resource for funding your property. Consider using a hard money loan next time you purchase a home.