Fix and flip companies use hard money loans because the application process provides faster access to cash, allowing the business to begin renovations as quickly as possible. However, there are a few qualifying aspects you need to be a suitable contender for this type of loan. While each loan is similar, each lender could differ in its requirements—read on for a general overview of the process in our beginner’s guide for securing a hard money loan.

For an introductory professional tip, if you are using our hard money lenders in Oklahoma City, ensure that you have a property in mind to begin. Lenders will need a detailed description and plan before agreeing to a deal. You can give them a courtesy call before the application process to guarantee they are interested in working with you and determine the necessary documentation and qualifying aspects.

Do You Have an LLC?

Does your fix and flip company have an LLC? This may not be a requirement, but having an LLC attached to your business name shows the hard money lenders that you are protecting your personal assets and take the job of flipping houses seriously. In the end, hard money loans are like a business transaction, so these lenders will do what’s necessary to secure a trustworthy deal with a client.

Do You Have Real Estate Experience?

These lenders want to work with someone who has prior experience. Otherwise, you cannot back up that you are reliable with your finances. If this is your first fix and flip, chances are you’ll be working with a first-time lender too. While finding a lender on your first go isn’t impossible, you will need to be more detailed with your budget and plans to win them over to your side. Consider hiring or learning from a veteran expert in your industry to give tips for obtaining your first hard money loan.

Know Your Numbers

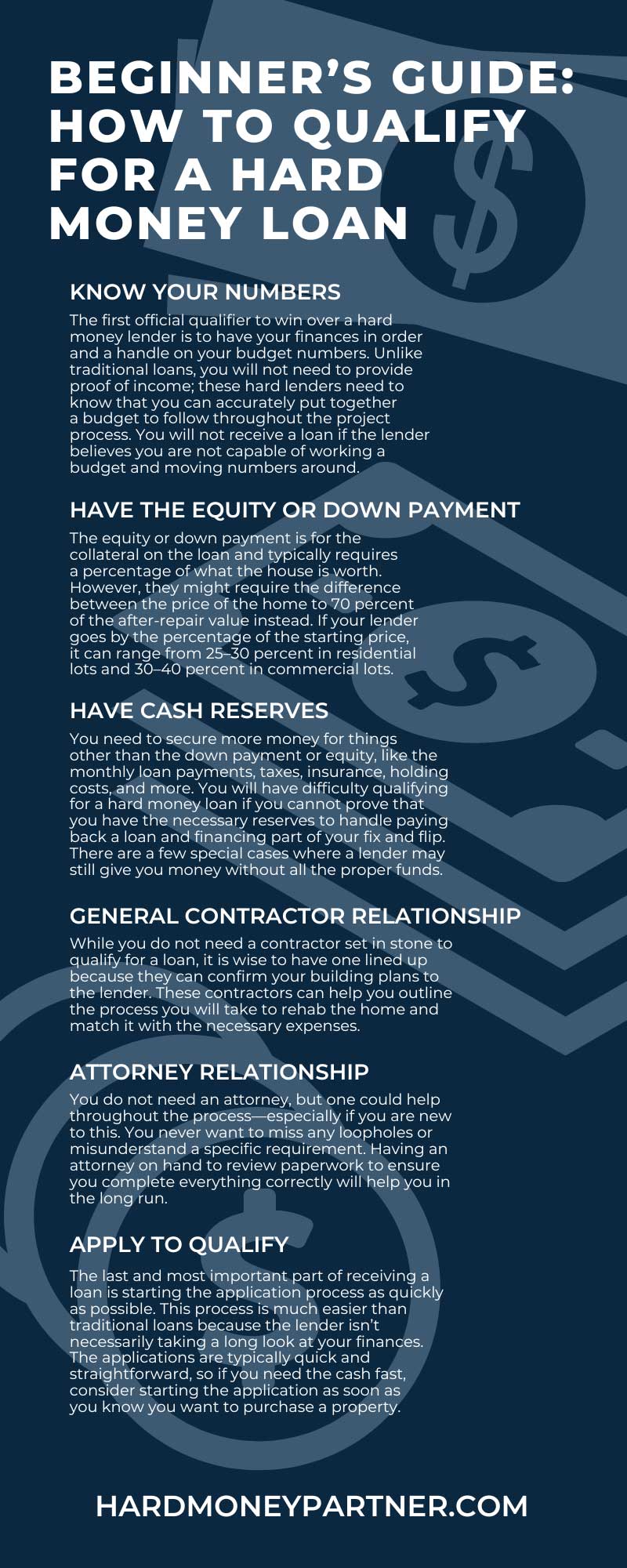

The first official qualifier to win over a hard money lender is to have your finances in order and a handle on your budget numbers. Unlike traditional loans, you will not need to provide proof of income; these hard lenders need to know that you can accurately put together a budget to follow throughout the project process. You will not receive a loan if the lender believes you are not capable of working a budget and moving numbers around.

In addition to having a detailed budget, have a plan in place for how you want to pay the loan back. These loans are short-term and require a faster turnaround of around 12 months—sometimes 24 months if you get lucky. Having these figures on paper will show the lender you understand every facet of your business and are ready to complete the job.

Have the Equity or Down Payment

The equity or down payment is for the collateral on the loan and typically requires a percentage of what the house is worth. However, they might require the difference between the price of the home to 70 percent of the after-repair value instead. If your lender goes by the percentage of the starting price, it can range from 25–30 percent in residential lots and 30–40 percent in commercial lots. Keep in mind that the more money you are willing to put into the property immediately, the less risk the lender will have to take, making them more likely to offer you a loan.

Have Cash Reserves

You need to secure more money for things other than the down payment or equity, like the monthly loan payments, taxes, insurance, holding costs, and more. You will have difficulty qualifying for a hard money loan if you cannot prove that you have the necessary reserves to handle paying back a loan and financing part of your fix and flip. There are a few special cases where a lender may still give you money without all the proper funds. However, you should still ensure your monthly payments do not go unpaid—they will typically use your property as collateral if you cannot make these installments.

General Contractor Relationship

Do you work with the same general contractor, or do you find new ones with every property you purchase? While you do not need a contractor set in stone to qualify for a loan, it is wise to have one lined up because they can confirm your building plans to the lender. These contractors can help you outline the process you will take to rehab the home and match it with the necessary expenses.

If you already have some experience with this, do not feel the need to hire one before qualifying for the loan. A general contractor can help push the process along and make the decision easier for the lender.

Attorney Relationship

You do not need an attorney, but one could help throughout the process—especially if you are new to this. You never want to miss any loopholes or misunderstand a specific requirement. Having an attorney on hand to review paperwork to ensure you complete everything correctly will help you in the long run.

Hard money lenders work in private organizations; therefore, the rules and requirements can differ from lender to lender. An attorney will ensure you understand everything you are getting into.

Apply To Qualify

The last and most important part of receiving a loan is starting the application process as quickly as possible. This process is much easier than traditional loans because the lender isn’t necessarily taking a long look at your finances. The applications are typically quick and straightforward, so if you need the cash fast, consider starting the application as soon as you know you want to purchase a property.

It may seem tedious, but hard money loans are quicker and easier to secure than traditional loans. Ensure that you understand the rules and regulations surrounding the loans so that you are not blind to any surprises that could happen down the road. Take your time speaking with lenders to find the right fit for you and your business. You also want to have the necessary documents and knowledge ready beforehand to make the deal go smoothly.